Forex trading can be an exciting yet challenging endeavor. To navigate the complexities of the foreign exchange market successfully, traders need to adopt effective techniques that will enhance their decision-making processes. From technical analysis to risk management, several strategies can be employed. One critical aspect is finding a reliable broker; for those in Ivory Coast, you might want to check out the forex trading techniques Best Ivorian Brokers to ensure you have access to the best trading tools and resources.

Understanding Forex Trading

Forex trading involves buying one currency while simultaneously selling another, taking advantage of the fluctuations in currency exchange rates. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This immense market provides ample opportunities for profit, but it also involves risks that require traders to be informed and strategic.

Essential Forex Trading Techniques

1. Technical Analysis

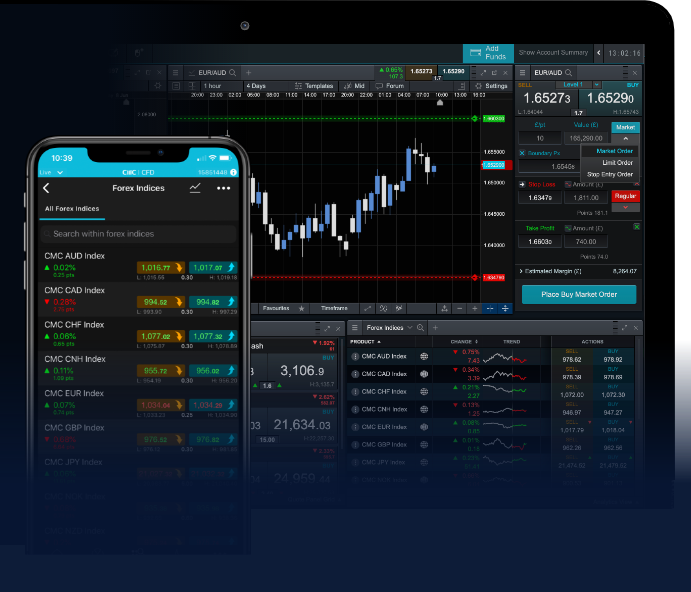

Technical analysis is one of the most popular methods among Forex traders. It involves analyzing historical price data and utilizing tools such as charts and indicators to forecast future price movements. Traders use various chart patterns, such as support and resistance levels, trendlines, and candlestick formations, to identify potential entry and exit points.

2. Fundamental Analysis

While technical analysis focuses on price movements, fundamental analysis examines the economic factors that influence currency values. This includes macroeconomic indicators, interest rates, inflation, and geopolitical events. By understanding how these elements affect currency markets, traders can make more informed decisions about when to buy or sell currencies.

3. Trading Strategies

There are several trading strategies that Forex traders can adopt, depending on their goals and risk tolerance:

- Day Trading: This strategy involves opening and closing positions within the same trading day. It requires a solid understanding of technical analysis and the ability to make quick decisions based on market movements.

- Swing Trading: Swing traders look to capitalize on short- to medium-term price fluctuations. They typically hold positions for a few days to several weeks, using both technical and fundamental analyses to make informed trades.

- Scalping: Scalping is a strategy that involves making an extensive number of trades throughout the day to capture small price movements. This requires a high degree of focus and quick execution.

- Position Trading: Position traders take a long-term approach, holding positions for weeks, months, or even years. This strategy is usually based on fundamental analysis, with an emphasis on the bigger economic picture.

4. Risk Management

Effective risk management is crucial to long-term success in Forex trading. This involves determining how much capital to risk on a single trade and using tools such as stop-loss orders to limit potential losses. A well-defined risk management plan helps traders minimize losses while maximizing potential gains. The general rule of thumb is to risk no more than 1-2% of your trading capital on any single trade.

5. Emotional Discipline

The psychological aspect of trading is often overlooked but plays a significant role in a trader’s success. Emotional discipline is essential to adhere to a trading plan and manage fear and greed. Traders must develop a mindset that allows them to remain calm during market fluctuations and avoid impulsive decisions that can lead to losses.

The Importance of Continuous Learning

Forex trading is an ever-evolving field, and continuous learning is key to staying ahead. Traders should invest time in educating themselves about market dynamics, new trading strategies, and the latest economic news. Online courses, webinars, and trading communities are excellent resources for gaining knowledge and sharing experiences with other traders.

Conclusion

In conclusion, mastering Forex trading techniques is essential for anyone looking to succeed in the currency market. By combining technical and fundamental analysis, adopting suitable trading strategies, practicing effective risk management, and maintaining emotional discipline, traders can optimize their trading performance. As traders explore these techniques, they will find a method that suits their individual trading style and ultimately enhances their profitability in the Forex market.

Recent Comments