Mastering Forex Currency Trading Online: Strategies for Success

Forex currency trading online has revolutionized how investors access the financial markets. The ability to trade currency pairs via user-friendly platforms opens up opportunities for both seasoned traders and newcomers. In this article, we’ll explore fundamental concepts, effective strategies, and tools necessary for trading forex successfully, including forex currency trading online Best Trading Apps.

Understanding Forex Trading

Forex, short for foreign exchange, refers to the global marketplace for trading national currencies against one another. Unlike stock markets, the forex market operates 24 hours a day, five days a week, allowing traders to execute trades at any time. Currency pairs are categorized into three groups: major pairs, minor pairs, and exotic pairs. Major pairs include the most widely traded currencies, like the Euro (EUR) and the US Dollar (USD).

The Mechanics of Forex Trading

Trading forex involves speculating on the price movement between currency pairs. For instance, if you believe the Euro will strengthen against the Dollar, you can buy the EUR/USD pair. Conversely, if you think the Euro will weaken, you might sell the pair. Prices fluctuate based on market forces, influenced by economic indicators, geopolitical events, and market sentiment.

Leverage and Margin

One of the unique aspects of forex trading is the use of leverage, allowing traders to control larger positions than their initial investment. For example, a leverage of 100:1 means that with $1,000 in your trading account, you can control $100,000 in currency. While leverage can amplify profits, it also increases potential losses, making risk management crucial.

Essential Strategies for Forex Trading

1. Technical Analysis

Technical analysis involves analyzing price charts and patterns to forecast future movements. Traders use various tools such as moving averages, Bollinger Bands, and Fibonacci retracement levels to identify potential entry and exit points. Understanding candlestick patterns also provides insights into market sentiment.

2. Fundamental Analysis

Fundamental analysis focuses on economic indicators that influence currency strength, including GDP, unemployment rates, and inflation data. Key events, such as central bank meetings and economic reports, can lead to significant market movements. Staying updated on global economic news is vital for traders relying on this strategy.

3. Risk Management

Effective risk management is critical in forex trading. Many traders follow the 2% rule, risking no more than 2% of their trading capital on a single trade. Implementing stop-loss orders helps to minimize losses and protect profits. Diversification across various currency pairs can also mitigate risks.

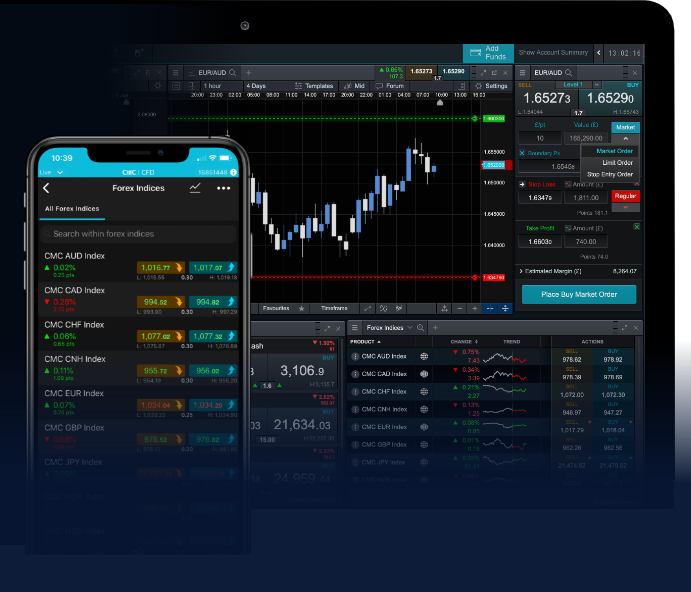

Choosing the Right Trading Platform

The right trading platform is fundamental to a trader’s success. Look for platforms with user-friendly interfaces, robust charting tools, and high liquidity. Many brokers offer demo accounts, allowing aspiring traders to practice without risking real money. It’s also essential to select a reputable broker that is regulated in your jurisdiction.

The Role of Trading Apps

In the modern trading landscape, mobile trading apps have become increasingly popular. They allow traders to monitor their positions and execute trades on-the-go, ensuring they never miss opportunities. Many apps also provide real-time market news, advanced charting features, and an overall seamless trading experience.

The Psychology of Trading

Successful forex trading isn’t just about strategies; psychological factors play a significant role. Emotional responses to market fluctuations can lead to irrational decisions. Developing a disciplined trading plan helps mitigate impulsive actions. Journaling trades can also be beneficial, allowing traders to learn from their mistakes and successes.

Getting Started with Forex Trading

To get started with forex trading, begin by educating yourself through books, online courses, and webinars. Establish a trading plan that outlines your goals, risk tolerance, and strategies. Start with a demo account to practice without financial risk before transitioning to a live account. Always stay informed about market news and continuously analyze your performance to enhance your trading skills.

Common Mistakes to Avoid

Experienced traders recommend avoiding common pitfalls, such as over-leveraging, neglecting risk management, and chasing losses. Many beginners also overlook the importance of having a well-defined trading strategy and become influenced by emotions rather than sticking to their plan. Currency trading is a journey that requires patience, discipline, and continuous learning.

Conclusion

Forex currency trading online presents vast opportunities for financial growth and independence. By understanding the fundamentals, employing effective strategies, and utilizing trusted trading platforms, traders can navigate the complexities of the forex market. Remember, success in forex trading is a marathon, not a sprint. Establish a solid foundation, stay disciplined, and keep learning to thrive in this exciting financial landscape.

Recent Comments