Mastering Forex Trading Using TradingView: Strategies and Tools

In the world of forex trading, having the right tools and resources is crucial for success. One of the most popular platforms among traders today is TradingView. This powerful charting tool not only offers advanced charting capabilities but also supports social networking features that allow traders to share their insights and strategies. In this article, we will delve into how to trade Forex effectively using TradingView, exploring its features, tools, and strategies for success. For those looking to enhance their trading journey, consider checking out trading forex in tradingview Trading Platform HK, which provides additional resources for traders.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves the purchasing and selling of currency pairs. The forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Traders seek to capitalize on fluctuations in exchange rates to earn a profit. The main goal in forex trading is to buy low and sell high, but this requires a deep understanding of market analysis and the factors that influence currency movements.

TradingView: An Overview

TradingView is a powerful web-based platform that offers a variety of tools for traders, including real-time data, advanced charting features, and the ability to conduct technical analysis. Traders from all levels of experience can benefit from the platform’s user-friendly interface and extensive features. Some of the standout features of TradingView include:

- Customizable Charts: Users can create and customize charts with a plethora of indicators, colors, and styles to suit their trading preferences.

- Social Networking: TradingView allows traders to share ideas, strategies, and insights with a global community, fostering collaboration and learning.

- Real-Time Market Data: Access to real-time forex data is vital for making informed trading decisions.

- Backtesting and Paper Trading: Traders can test strategies using historical data or practice trading without real money.

Getting Started with Forex Trading on TradingView

To begin trading forex on TradingView, you first need to create an account. The platform offers a free version with basic features, or you can choose a paid subscription for more advanced tools. Here’s a step-by-step guide to get started:

- Create an Account: Visit the TradingView website and sign up for an account by providing the required information.

- Explore the Interface: Familiarize yourself with the layout of the platform, including the charting tools and indicators available.

- Select Currency Pairs: Use the search function to find and add the currency pairs you wish to trade.

- Apply Technical Analysis Tools: Utilize the various indicators, drawing tools, and chart types to analyze market trends.

- Set Up Alerts: TradingView allows users to set alerts for price movements, helping you stay informed.

Key Strategies for Forex Trading Using TradingView

When trading forex, developing a strategy is key to success. Here are some effective strategies you can implement using TradingView:

1. Trend Following

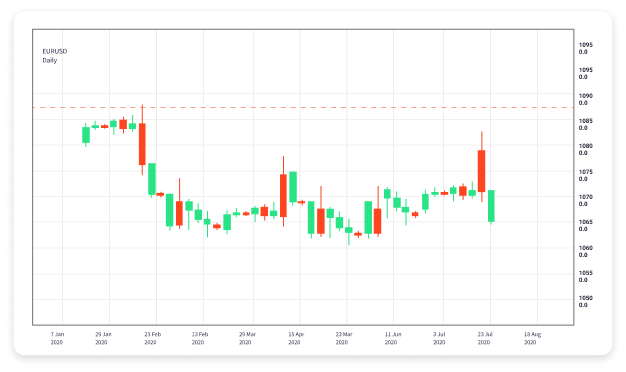

The trend-following strategy involves identifying the direction of the market trend and making trades based on that trend. On TradingView, you can utilize Moving Averages and trend lines to spot potential entry and exit points. The key is to buy when the market is in an uptrend and sell during a downtrend.

2. Support and Resistance

Support and resistance levels are critical in forex trading. Support is the price level at which a currency pair typically bounces back upward after declining, while resistance is the level at which it hesitates before falling. You can easily mark these levels on TradingView charts and use them to plan your trades.

3. Breakout Trading

Breakout trading involves entering a position when the price breaks through a significant level of support or resistance. This strategy can be particularly effective in volatile markets. Use TradingView’s alerts to notify you of potential breakout opportunities.

Analyzing Forex Markets with TradingView Tools

Analyzing the forex market effectively requires utilizing multiple tools available on TradingView:

Technical Indicators

TradingView offers an extensive range of technical indicators including Relative Strength Index (RSI), Bollinger Bands, and MACD. These tools help traders assess market conditions and forecast potential price movements.

Chart Patterns

Recognizing chart patterns like head and shoulders, flags, and triangles can provide insights into future price movements. Utilize TradingView’s drawing tools to identify and mark these patterns on your charts.

Economic Calendar

Stay updated with economic events that can impact forex markets. TradingView features an economic calendar that highlights upcoming events, allowing you to prepare and adjust your trading strategies accordingly.

Risk Management in Forex Trading

One of the most crucial aspects of trading is risk management. Even the best strategies can fail without proper risk management measures. Here are a few tips to manage your risk effectively while trading forex on TradingView:

- Define Your Risk Per Trade: Limit your risk to a small percentage of your trading capital on each trade, often recommended to be no more than 1-2%.

- Set Stop-Loss Orders: Always use stop-loss orders to protect your capital from significant losses.

- Maintain a Trading Journal: Keep track of your trades, including your reasoning and outcomes, to learn from your successes and mistakes.

The Importance of Continual Learning

The forex market is constantly evolving, and so should your trading knowledge. Continuously educate yourself about market trends, trading strategies, and economic factors that influence currency movements. Leverage the community features on TradingView to engage with other traders, share insights, and learn from their experiences.

Conclusion

Trading forex can be a rewarding venture when approached with the right tools and strategies. TradingView stands out as an outstanding platform for both novice and experienced traders, providing the necessary resources to analyze markets effectively. By understanding key strategies, utilizing TradingView’s features, and maintaining disciplined risk management practices, you can enhance your forex trading experience and work towards achieving your trading goals. Remember, continual learning and adaptation are key to navigating the complexities of the forex market successfully.